The Guide to Private Equity Due Diligence Meetings: How GPs Can Prepare for LP Fund Investment Reviews

February 12, 2025

Updated November 2025

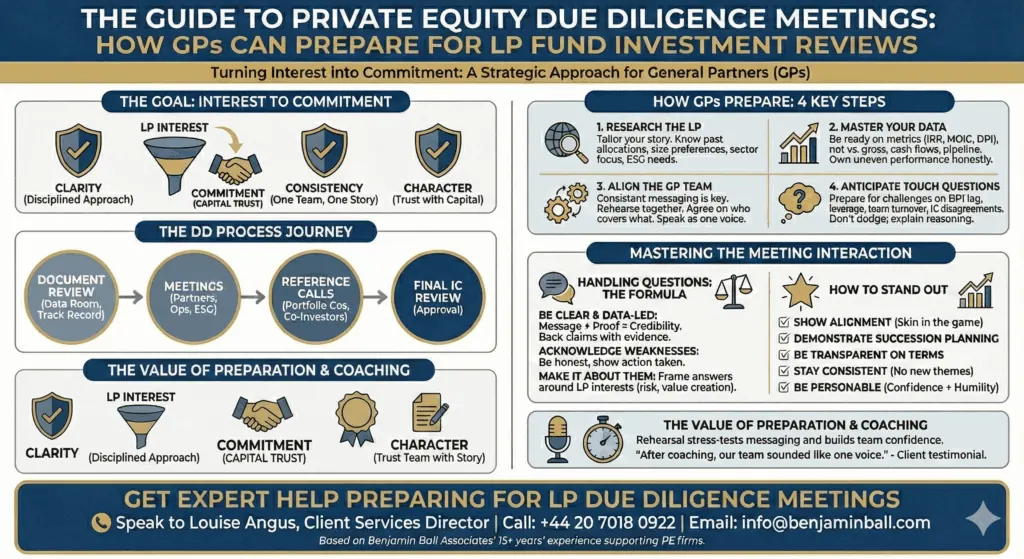

When you’re raising a private equity fund, few moments matter more than the due diligence meeting. It’s your chance to turn interest into commitment. LPs use these meetings to dig into your strategy, test your track record and decide if they trust you with their capital for the next decade.

Meet the Author: Benjamin Ball

Ben is the founder of London-based Benjamin Ball Associates and leads the presentation coaching and pitch deck creation teams. Formerly a corporate financier in the City of London, for 20+ years he’s helped businesses win with better pitches and presentations, particularly investor pitches. He is a regular speaker and a guest lecturer at Columbia Business School and UCL London. Follow Ben on LinkedIn or visit the contact page.

This guide explains the private equity due diligence process from a GP’s point of view. You’ll learn what LPs are really looking for, how to prepare your team and how to handle tough questions with confidence.

This is based on the Benjamin Ball Associates’ 15+ years’ experience supporting PE firms during fundraising with advice, coaching, and DD meeting role plays.

Sone of our PE clients:

Get a free quote. Speak to an expert

What Is a Private Equity Due Diligence Meeting?

In private equity fundraising, due diligence meetings are where LPs move from curiosity to conviction. After reviewing your pitch deck, data room and performance numbers, they’ll want to meet you face-to-face (or virtually) to test your thinking.

An LP due diligence meeting typically comes late in the process. By this stage, an LP is seriously interested. They’re now assessing the people behind the performance — checking how your team works, whether your story holds up under scrutiny and whether they believe you’ll deliver consistent returns.

Think of it as an investment interview. LPs are looking for:

- Clarity – Do you have a disciplined investment approach?

- Consistency – Does everyone in your team tell the same story?

- Character – Can they trust you to look after their capital?

For you as a GP, it’s a chance to reinforce your core messages and demonstrate the strength of your fund, team and investment process.

Understanding the Private Equity Fund Due Diligence Process

The due diligence process in private equity helps LPs validate everything they’ve learned about your fund. It often includes:

- Document Review – LPs will already have studied your data room, track record and fund terms.

- On-site or Virtual Meetings – These include discussions with your partners, investment professionals, finance, ESG and operations teams.

- Reference Calls – LPs may speak to portfolio company management, previous co-investors and even former employees.

- Final Investment Committee Review – Once the LP’s team is satisfied, they will go to their internal committee for approval.

Every step tests your transparency, preparation and alignment. If your messaging is inconsistent or your numbers unclear, you’ll raise doubts.

If you’re confident, open and well-prepared, you’ll build trust — and that’s what wins commitments.

How to Prepare for a Private Equity Due Diligence Meeting

1. Research the LP Thoroughly

Every investor is different. A sovereign wealth fund will have very different due diligence priorities from a family office or corporate pension scheme.

Before the meeting, research:

- Their past PE allocations

- Fund sizes they’ve backed

- Geographic or sector preferences

- ESG requirements or governance standards

Use this insight to tailor your story. Emphasise how your fund fits into their broader portfolio and how your strategy complements their goals.

2. Master Your Fund’s Data

Nothing undermines confidence faster than uncertainty about numbers. Be ready to discuss:

- Performance metrics – IRR, MOIC, DPI, and TVPI by fund and vintage

- Net vs. gross returns – LPs care about real results

- Cash flows and exit history – Be ready to talk through case studies

- Pipeline – Show you have a credible plan to deploy capital

If performance has been uneven, own it. Explain what happened, what you learned, and how your approach has evolved.

LPs respect honesty backed by evidence.

3. Align the GP Team

A successful private equity fund due diligence meeting depends on consistent messaging. Every partner and associate should tell the same story — with their own voice but shared facts and emphasis.

Agree beforehand who covers which areas (performance, ESG, pipeline, operations). Then rehearse together until it feels natural. Nothing builds LP confidence like a GP team that speaks as one.

Rehearsing your team with a professional coach makes it more likely that the LP hears a consistent story from everyone.

4. Anticipate Tough LP Questions

LPs will challenge you — not to catch you out, but to see how you think. Prepare for questions such as:

- Why has DPI lagged behind MOIC?

- How do you manage portfolio company leverage in downturns?

- What happens if a key partner leaves?

- How do you handle investment committee disagreements?

The best answers are simple, factual and reflective. Don’t dodge or defend. Instead, explain your reasoning, your process and what you’ve learned along the way.

How to Handle Questions During the Due Diligence Process

Be Clear, Direct, and Data-Led

LPs appreciate concise, evidence-based answers. Use this formula:

Message + Proof = Credibility.

If you claim your portfolio is resilient, back it up with data or examples.

Avoid long, meandering explanations. The tighter your answer, the more confident you sound.

Acknowledge Weaknesses Honestly

Every fund has challenges. Whether it’s a failed exit, turnover in the team, or a fundraise that took longer than expected, address it openly. Then show how you’ve acted on it.

Example:

“That investment didn’t meet our expectations, but we identified the issue early, changed leadership, and recovered half the value. It reinforced our focus on operational oversight.”

Handled this way, weaknesses become proof of your professionalism.

Make It About the LP

Remember: this isn’t your meeting, it’s theirs. Frame your answers around their interests — how you protect capital, manage risk and deliver steady value creation.

Build a conversation, not a lecture. Ask questions too:

“How does your IC view concentration risk?”

“Would you like more detail on how we manage co-investments?”

Engagement builds trust far faster than a one-way monologue.

Case Study: Coaching a Mid-Market PE Firm for LP DD Meetings

A European mid-market PE firm approached Benjamin Ball Associates ahead of a series of private equity fund investment due diligence meetings with LPs from Europe, the US and Asia.

Through intensive role play, we replicated real LP questioning styles — from box-ticking interviews to aggressive interrogations. The sessions revealed gaps in their story, inconsistencies between team members, and unclear explanations of performance.

After refining their messages and practising realistic LP scenarios, the team felt confident and cohesive. The partners could handle complex questions clearly, and the associates understood how to reinforce key messages. The result: stronger meetings, better feedback and faster commitments.

How to Stand Out in a Private Equity LP Meeting

When LPs are comparing multiple managers, small details make the difference.

To stand out:

- Show alignment – Be clear about your own commitment to the fund (skin in the game)

- Demonstrate succession planning – LPs want to know your firm will thrive beyond the current partners

- Be transparent on terms – Explain fees, carry and fund size rationale confidently

- Stay consistent – Don’t introduce new themes that weren’t in your pitch deck

- Be personable – LPs back people, not just strategies

Confidence matters — but humility and clarity win trust.

Why Preparation Is Everything in Private Equity Due Diligence

The private equity due diligence process is designed to uncover risk. Your preparation is your best defence.

That’s why many top GPs rehearse with professional coaches before meeting LPs. They stress-test messaging, anticipate tough questions, and make sure the whole team can handle pressure calmly.

As one client put it:

“After the coaching, our team sounded like one voice. We were ready for anything.”

Final Thoughts: Turning Due Diligence into a Win

A successful private equity fund due diligence meeting is not about perfect answers — it’s about confidence, honesty, and clarity. LPs are looking for long-term partners who are disciplined, transparent and self-aware.

When you prepare properly, you don’t just survive due diligence. You use it to reinforce your strengths and show LPs that their capital will be in safe hands.

Get Expert Help Preparing for LP Due Diligence Meetings

For over 15 years, Benjamin Ball Associates has helped private equity teams prepare for due diligence meetings and investor presentations.

Through role play, coaching and message development, we help you:

- Refine your fund story

- Rehearse tough LP questions

- Build confidence across your GP team

If you’d like help preparing for your next private equity due diligence meeting, speak to an expert today.

Call Louise Angus, client services director on +44 20 7018 0922 or email info@benjaminball.com

Get a free quote. Speak to an expert

Why Choose Us:

Transform your pitches and presentations with tailored coaching

We can help you present brilliantly. Thousands of people in the UK, Europe and the Middle East have benefitted from our tailored in-house coaching and advice – and we can help you too.

“I honestly thought it was the most valuable 3 hours I’ve spent with anyone in a long time.”

Mick May, CEO, Blue Sky

For 15+ years we’ve been the trusted choice for leading businesses and executives throughout the UK, Europe and the Middle East. We’ll help you improve corporate presentations through presentation coaching, public speaking training and expert advice on pitching to investors.

Some recent clients

Unlock your full potential and take your presentations to the next level.

Speak to Louise on +44 20 7018 0922 or email info@benjaminball.com to transform your speeches, pitches and presentations.

Get a free quote. Speak to an expert

Private Equity Due Diligence FAQs

What is private equity due diligence?

Private equity due diligence is the process investors use to assess a fund before committing capital. LPs (Limited Partners) examine a GP’s track record, strategy, team, and governance to confirm whether the fund is a good fit for their portfolio. It combines document review, meetings, and reference checks.

What happens in a private equity LP meeting?

An LP meeting is where investors test what they’ve learned from your pitch and data room. They’ll ask detailed questions about your performance, deal sourcing, risk management, and decision-making process. It’s a key part of the private equity fund due diligence process and helps LPs decide if they can trust your team with their capital.

How can GPs prepare for private equity fund investment due diligence?

Start by understanding each LP’s priorities and investment history. Rehearse your team’s answers to common questions, align your messaging, and master your fund data. Many GPs work with professional coaches to simulate realistic LP meetings and refine their delivery before the real thing.

What are LPs looking for during due diligence?

LPs are assessing clarity, consistency, and credibility. They want to see a disciplined investment process, alignment of interests, and a cohesive team. LPs also test how you respond to pressure, particularly when discussing underperforming investments or internal challenges.

What’s the difference between fundraising and due diligence meetings?

A fundraising meeting introduces your fund and story. A due diligence meeting digs deeper into how you operate. By the time LPs reach the due diligence stage, they’re already interested — they just need to validate what you’ve told them and confirm that your team delivers on its promises.

How long does the private equity due diligence process take?

It varies. For many institutional LPs, full fund investment due diligence can take several weeks or months, depending on the size of the fund and the complexity of the data. The meeting itself may last from a couple of hours to a full day and involve multiple team members.

Why do GPs use coaching before due diligence meetings?

Coaching helps GPs stress-test their story, improve how they handle difficult questions, and ensure every team member is confident and consistent. It’s particularly valuable when preparing for LP meetings where first impressions and clarity are critical.

If you’d like help preparing for your next private equity due diligence meeting, speak to an expert today.

Contact us now for free consultation

Start improving your pitches and presentations now

Contact us now and speak to an expert about getting award-winning coaching, training and advice